Looking at Trump Mobile's original promises, you could be forgiven for getting excited about an American-made smartphone that could compete with the big players and support domestic manufacturing. The Trump Organization's T1 Phone launched with bold claims about being "MADE IN THE USA" and bringing smartphone production back to American soil. Then the messaging shifted, the big talk faded from the website, and the reality of smartphone manufacturing caught up.

The story of Trump Mobile's manufacturing claims runs straight into the hard wall of 2025 supply chains. Despite early promises of American manufacturing, The Independent reports that Trump Mobile removed "made in the USA" language from its site, swapping in softer phrasing about being "brought to life" in America. Eric Trump said "eventually" phones could be built in the U.S., implying early units may be produced elsewhere, despite what company spokespersons suggested earlier. The $499 price tag raises its own red flags, experts noted that figure is far too low for a truly American-made device.

What makes the whole episode revealing is the gap between political swagger and economic gravity. While a spokesperson for the company said, "T1 phones are proudly being made in America," the fine print tells a different story. The site now leans on careful phrasing, "American-Proud design" and "brought to life right here in the USA," rather than a clear claim of domestic manufacturing. That linguistic sidestep points to the constraints Trump Mobile is facing.

Why American smartphone manufacturing remains a pipe dream

The core challenge is not about patriotism. It is about missing infrastructure that took decades to build in Asia and costs that make domestic production prohibitive. Counterpoint Research analyst Blake Przesmicki said that despite the American-made pitch, "it is likely that this device will be initially produced by a Chinese original design manufacturer." When The Wall Street Journal asked supply-chain experts about building a completely US-made iPhone-caliber device, they estimated years and a multi-billion dollar commitment to create the infrastructure, with phones that would cost more than China-made models.

The gap is not just assembly lines. Core components like AMOLED displays, VCSEL sensors for face unlock, and camera modules are not manufactured domestically, according to Mashable. Johns Hopkins University research suggests five years just to lay the groundwork for American smartphone manufacturing, and that assumes massive spending. Wilson Rothman from The Wall Street Journal put it plainly: "The thing about manufacturing phones in America is you have to have an infrastructure. You have to have a workforce. You have to have things that you can't just snap your fingers or even throw $500 billion at. It is not a problem that can be solved just with money. It really is a decades-in-the works kind of project."

The telltale signs pointing to Chinese manufacturing

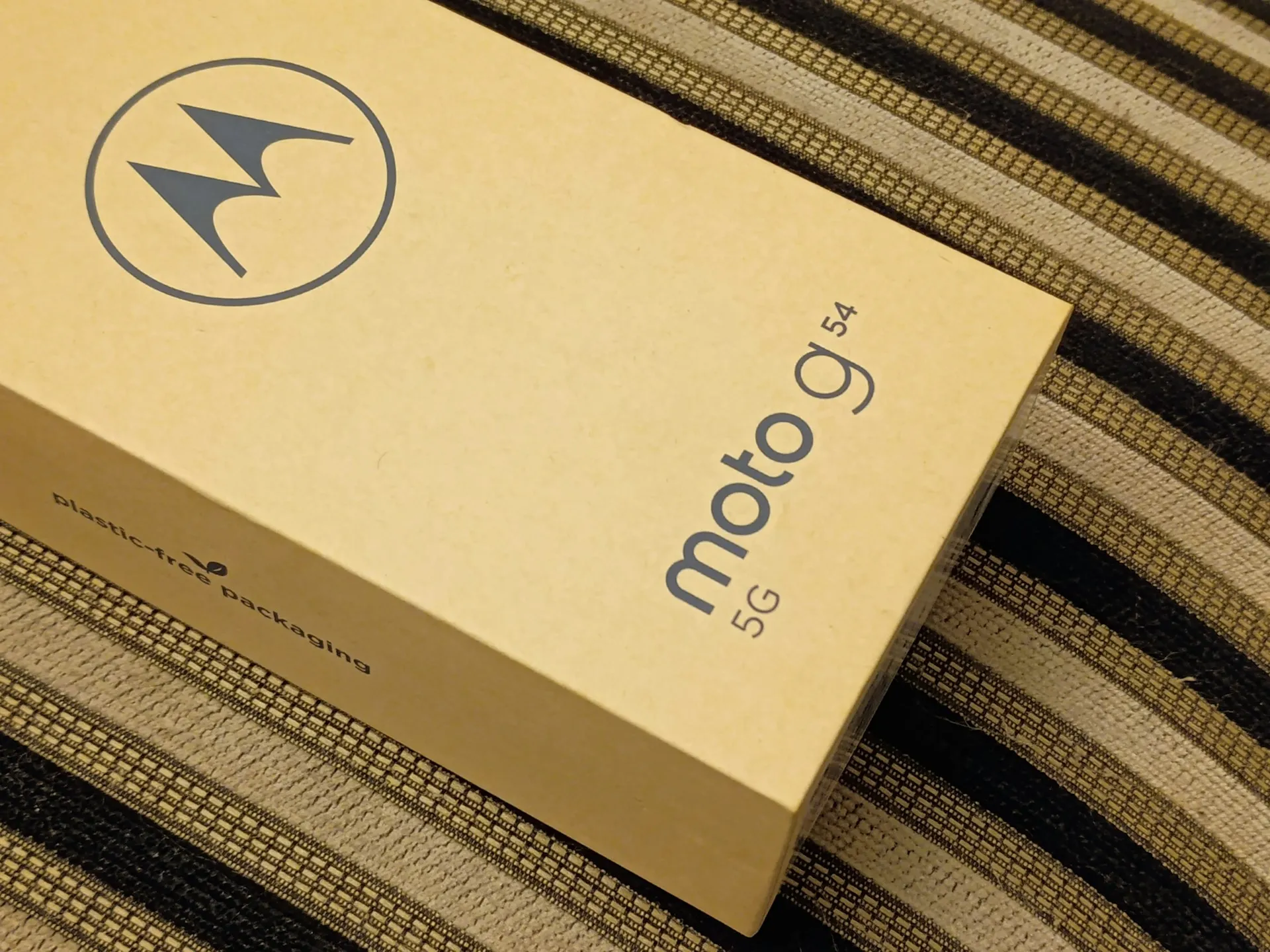

Analysts see striking similarities between the T1 Phone and existing Chinese-manufactured devices. Max Weinbach from Creative Strategies noted that the T1 appears to be "the same device as the T-Mobile REVVL 7 Pro 5G, custom body," manufactured by Wingtech in China. CNN's investigation found that both the T1 and the Chinese-made Revvl share identical specifications, same screen size, battery capacity, storage, and even the rare inclusion of a headphone jack.

That is not coincidence, it is how modern smartphone development runs. When two phones match on battery capacity down to the milliamp hour, repeat the same camera setup, and keep a niche feature like a headphone jack, you are usually looking at the same original design manufacturer.

Parts sourcing seals the point. Economic Times analysis says almost all major T1 components come from overseas, a 6.8-inch AMOLED display likely from Samsung, LG, or BOE, processors from Taiwan's MediaTek, and camera sensors from Japan's Sony. Even if some memory chips come from US-based Micron, those components often rely on global supply chains. Francisco Jeronimo from IDC told NBC, "There is no way the phone was designed from scratch or will be assembled entirely in the U.S. That is completely impossible."

What this means for consumers and the industry

The Trump Mobile episode spotlights a broader truth about smartphone production. Wedbush Securities analyst Dan Ives summed it up, "You do not have the infrastructure, the manufacturing or the skilled labor" for large-scale US smartphone builds. Even Apple, with enormous resources, still relies on Asian supply chains.

Consider what Trump Mobile is promising. They say they can do in months what Apple, Google, Samsung, and everyone else have not found economically viable. These are companies that have spent decades tuning supply chains and would love to reduce overseas dependence if it made financial sense.

Pricing tells the story. The only smartphone that approaches a "Made in America" label is the Librem 5 USA, and it comes with serious trade-offs in features and functionality. Analysts estimate that a truly American-made iPhone could cost what Trump Mobile initially projected for its own device, without the advanced features consumers expect.

The T1's shifting specifications add more context. Trump Mobile initially claimed the phone had 12GB of RAM but later removed that specification entirely, and the screen size changed from 6.78 inches to 6.25 inches in the marketing. Those are not the tweaks of a company in full control of a factory floor. They look like the adjustments that happen when you are working from an existing design.

The bottom line on American smartphone manufacturing

Trump Mobile's retreat from "Made in USA" mirrors the same forces that sent almost every major smartphone maker to Asia. The Hill's analysis notes that companies often import mostly finished products and add final touches in the US, a path that allows "built in America" claims without real domestic manufacturing.

Here is the key distinction to keep straight, there is a significant difference between products technically assembled in the US and those that can claim "Made in America" status, which requires most components to be domestically produced. That is how Trump Mobile can thread the needle between technically accurate language and genuine US manufacturing.

There is also a twist. The company could be squeezed by the very tariff policies associated with its namesake. The Hill reports that "Trump's own tariffs could come back to bite the T1," since components "almost certainly have to come from China or from Vietnam or from India or countries in Asia Pacific."

For consumers hoping for affordable, truly American-made smartphones, this saga says the dream is still out of reach. Modern phones depend on a global web of specialists, from display makers to chip foundries to precision assembly plants. Recreating that ecosystem at home would take staggering investment and time, plus higher prices.

Could it happen someday? Maybe, if someone commits for a generation and swallows the cost. Until then, American smartphone manufacturing will sound more like a slogan than a production line.

Comments

Be the first, drop a comment!