Picture this: You walk into a phone store looking for the latest Sony Xperia, only to find empty shelves where they used to be. That's increasingly becoming reality across major markets, and it's raising a question that would've seemed impossible just a few years ago — are we witnessing the twilight of Sony's smartphone ambitions?

The signs are everywhere. Sony officially announced it will no longer sell Xperia smartphones through its European subsidiary, with the dedicated European website quietly shutting down. For the second consecutive year, Sony has opted not to distribute its flagship smartphone in the United States. Meanwhile, Sony shipped just 1.3 million Xperia devices in the last quarter, with projections anticipating only 700,000 units in the current period.

If you've walked through a Best Buy or carrier store lately, you've probably noticed the shift — Sony's once-prominent display space has shrunk to virtually nothing, with Samsung and Apple dominating the premium real estate that Xperia once commanded.

As someone who's tracked mobile tech daily for the past five years, here's what's really happening behind Sony's slow retreat — and whether there's any path back from the brink.

The numbers don't lie: A brand in freefall

Let's break down just how dramatically Sony's smartphone fortunes have shifted. Having witnessed Sony's peak years and subsequent decline firsthand, the reality is stark, and the data tells a story of consistent decline that's hard to ignore.

Sony's market share has plummeted from a respectable position to barely registering on global charts. According to Insider Monkey data, Sony had a global market share of only 3.5% in the first half of 2024. To put that in perspective, a Bloomberg analysis suggests Xperia's global market share dropped from around 11% in 2014 to just 2% in 2024 — that's an 80% decline in a decade.

The situation in Sony's home market is equally telling. According to a Bloomberg report citing IDC data, Sony's smartphone sales in Japan plummeted by a whopping 40% in 2023. Since then, Sony has not published official sales numbers for Xperia smartphones — never a good sign when a company goes dark on metrics.

What makes these numbers particularly troubling is the scale required for smartphone R&D sustainability. Sony Group Corp. sold about 3.7 million smartphones worldwide in the first half of 2024, generating $2.5 billion in revenue. While that sounds impressive, industry analysts estimate that maintaining competitive smartphone development requires annual sales of at least 50 million units to justify the massive investments in chipset optimization, camera technology, and software development.

Compare this to the broader smartphone recovery story. According to IDC, global smartphone shipments increased 7.8% year over year to 289.4 million units in Q1 2024, marking the third consecutive quarter of growth. While the overall market rebounds, Sony's absence from these growth charts speaks volumes about how far they've fallen behind.

What went wrong: The perfect storm of missteps

Sony's smartphone struggles aren't the result of a single catastrophic decision — they're the culmination of years of strategic missteps that collectively created an almost impossible market position.

The carrier relationship breakdown represents perhaps the most damaging long-term issue. Sony's inability to snag a deal with any U.S. carrier has been one of the big reasons why the Xperia line didn't catch on in the States. This forced Sony to stop shipping to the third-largest smartphone market in the world — a decision that's hard to recover from when you're already fighting for relevance.

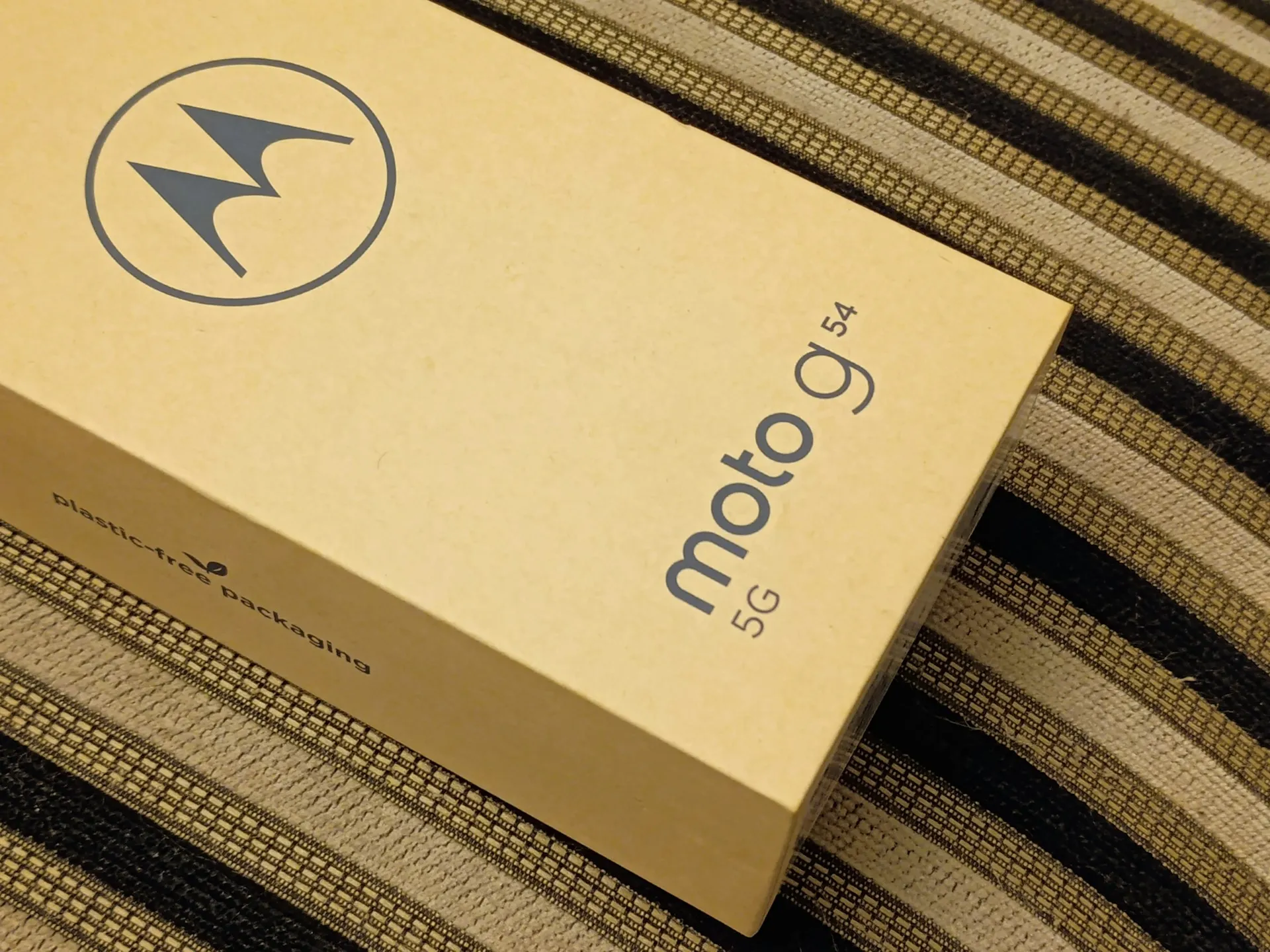

The manufacturing pivot tells an even more troubling story of cost pressure cascading from lost carrier revenue. Sony has made significant changes to its smartphone production strategy, moving from three internal manufacturing facilities to third-party assembly. Recent information from Sony's manufacturing websites reveals that these plants no longer list smartphones among their production capabilities. When you're losing carrier subsidies and volume discounts, outsourcing manufacturing becomes a necessity rather than a choice — but it also signals declining internal commitment to the mobile business.

Quality control issues have made matters worse, undermining the premium positioning Sony desperately needs to survive at low volumes. Sony has identified potential power issues with the Xperia 1 VII, including unexpected power-offs, restarts, and inability to power on. Sony has halted sales and shipments of the Xperia 1 VII in its native Japan, with affected phones spontaneously resetting and refusing to turn back on. When your flagship device can't even launch properly in your home market, that's a credibility crisis that makes distribution challenges exponentially worse.

The withdrawal accelerates: Market by market retreat

Sony's retreat isn't happening all at once — it's a calculated market-by-market withdrawal that reveals just how unsustainable their current position has become, following patterns that suggest systematic cost reduction over expansion.

The European exit represents the most dramatic recent development. Sony confirmed to Suomimobiili that the distribution of Xperia phones in Europe will be limited in the future. In Finland, many models won't be offered at all. In other European countries, Xperia smartphones will primarily be sold at Sony's official online store and Amazon — a far cry from the broad retail presence needed for mass market success.

The U.S. market tells a similar story of strategic abandonment driven by network compatibility challenges that really reflect deeper carrier relationship failures. Sony confirmed to The Verge that it has no plans to launch the Xperia 1 V in the US, with no official way to buy the new Sony flagship stateside. The global version of the Xperia 1 XI is available via Amazon, but this is a GSM phone which means it won't work on Verizon.

What's particularly telling is how these geographic withdrawals are approaching minimum viable market thresholds. Industry research suggests that smartphone brands need presence in at least 40 major markets to achieve the scale necessary for sustainable operations. Sony's systematic retreat from Europe and North America leaves them primarily dependent on Japan and select Asian markets — a base potentially too narrow to support ongoing flagship development.

Where do we go from here?

The evidence paints a picture of a company that's systematically retreating from the smartphone market, but the question remains: is this a strategic repositioning or the beginning of the end?

Sony's focus on niche markets might be their only viable path forward. In its 2024 statement, Sony clarified that full-frame sensors won't be coming to smartphones anytime soon due to physical limitations and thermal constraints. Instead, they're doubling down on innovations like stacked CMOS sensors and advanced computational optics. The Xperia 1 VII features Sony's Exmor T stacked CMOS sensors on all three lenses, targeting content creators and filmmakers rather than mainstream consumers.

The challenge is whether niche strategy success stories can translate to Sony's situation. OnePlus built a sustainable business from enthusiast beginnings, but they had carrier partnerships and aggressive pricing that Sony lacks. RED's cinema camera approach worked in a market with higher margins and professional buyers — luxuries Sony doesn't have in the hypercompetitive smartphone space.

The numbers suggest this niche strategy faces serious challenges. Sony Group Corp. sold about 3.7 million smartphones worldwide in the first half of 2024, generating $2.5 billion in revenue. While impressive per-unit revenue, these volumes are simply too small to justify the massive R&D investments needed to compete with Apple, Samsung, and Chinese manufacturers who are achieving historic milestones with 56% of global smartphone shipments.

The Xperia era isn't technically over — yet. But unless Sony can find a way to reverse these trends or discover a sustainable niche model that others haven't, we may be witnessing the slow but inevitable conclusion of one of the most technically ambitious smartphone lines ever created. For those of us who appreciated Sony's unique approach to mobile technology, that's a loss that goes far beyond market share statistics.

Comments

Be the first, drop a comment!