It's become a routine for many of us to ring in the New Year with pledges to finally get our budgets and finances under control. Unfortunately, it's also quite difficult to to keep those promises. Some of us will just dive into our resolutions and wing it as we move forward, which usually ends in failure. But even for those of us who plan carefully, obstacles along the way can spell doom for New Year's resolutions.

When I think of my finances, I'm often reminded of those times when I injured myself and got a deep cut, being terrified to look at the bloody mess. I feel the same way whenever I have to face my budget—but unfortunately, the only way to handle it is to take a long hard look at that bloody pulp, so you can devise a plan to get the ball rolling. These three apps for iPhone and Android will make treating your open monetary wound suck less, while enabling you to spend better and save more.

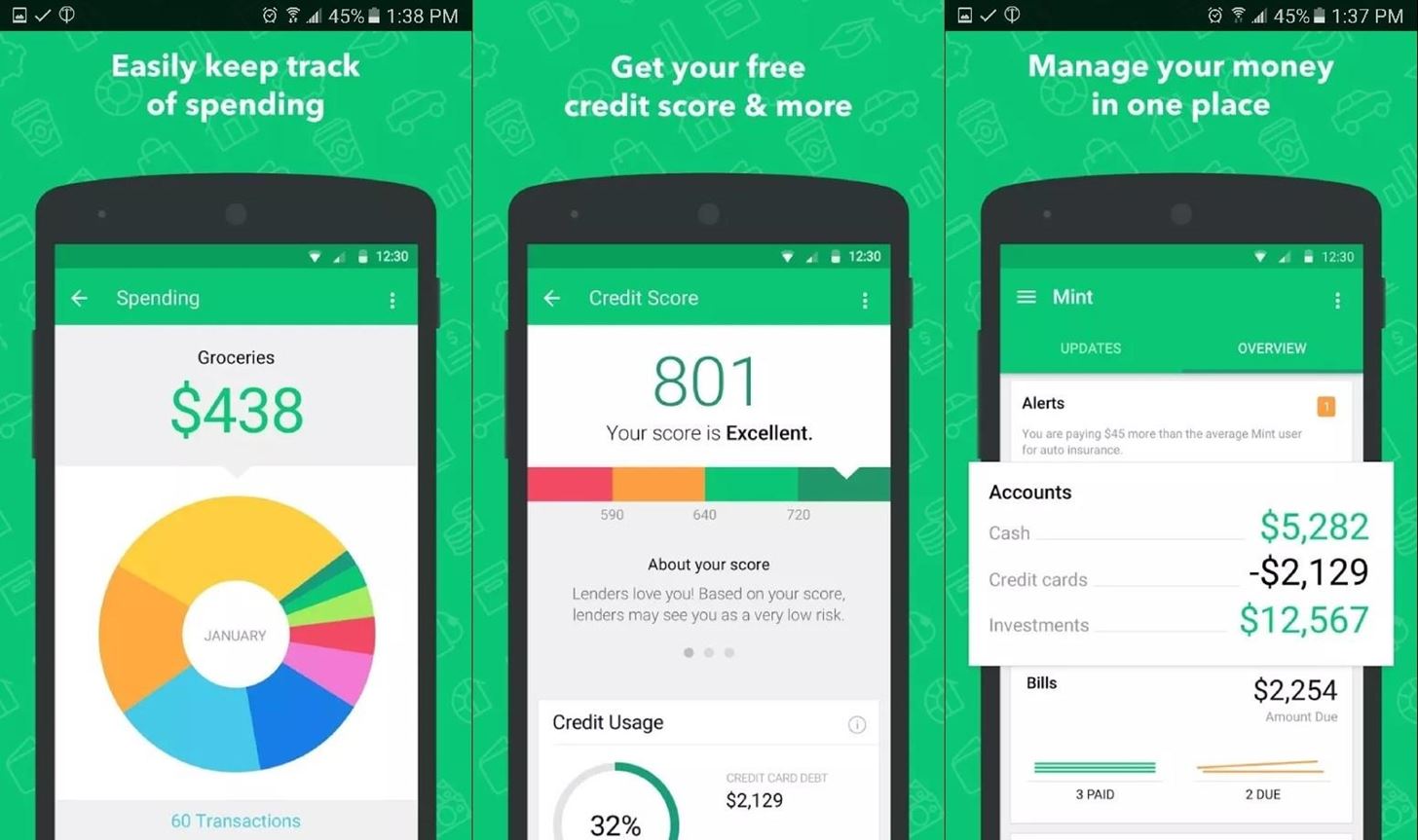

1. Mint

Mint is by far the most popular budgeting app, as making a budget with it is incredibly simple and convenient. Just connect Mint to your bank and the app will largely take care of the rest, using your details to help create a personalized budget.

From the team that brought you TurboTax and Quicken, Mint uses the same security features as banks and major financial institutions, so you can rest assured that your data is in very safe hands. Mint will send you alerts to unusual charges and will help identify tips tailored to your spending that can potentially save serious money on fees and on other bills.

Mint also includes your credit score, so you can see an overview of your budget, and always know where you stand with your personal finances.

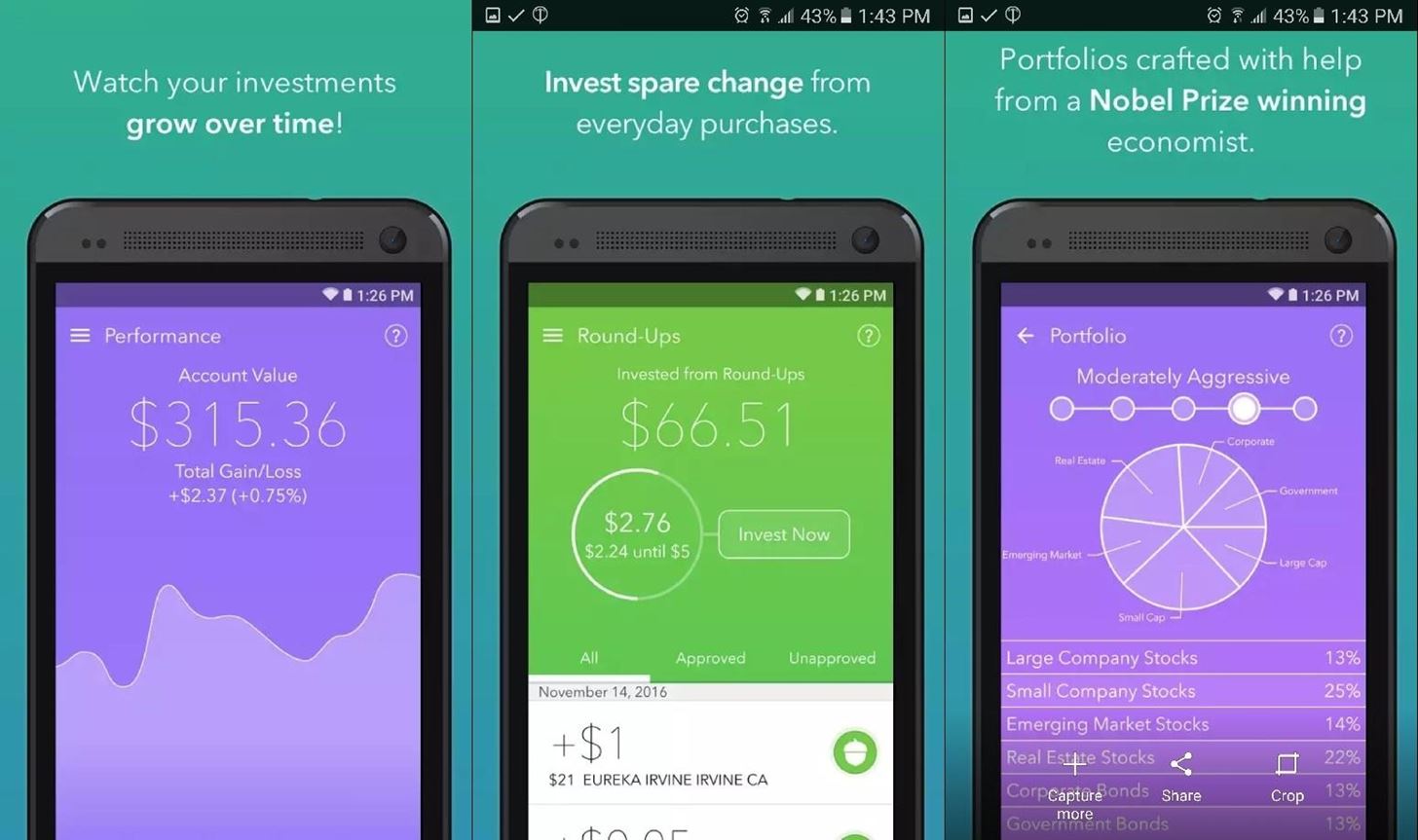

2. Acorns

Acorns is a popular app that allows you to automatically save money through round-ups. You can schedule Acorns to withdraw a certain amount off your linked bank account, or simply deposit anytime you want. The app puts the money in an investment portfolio, and gives you an option in picking your portfolio.

You can choose to focus on saving long-term or aggressively, depending on how risk-averse you are. Acorns will divvy up the funds accordingly, and your savings will fluctuate with the markets. Saving long term will give your money time to grow, as market trends tend to go upwards in the long run. Nonetheless, you can withdraw your cash at any time without penalties.

Acorns is free to download, but will charge your account $1 per month for investments less than $5,000, and switches to 0.25% a year once it passes that threshold. Give Acorns a try and see how far your loose change will go.

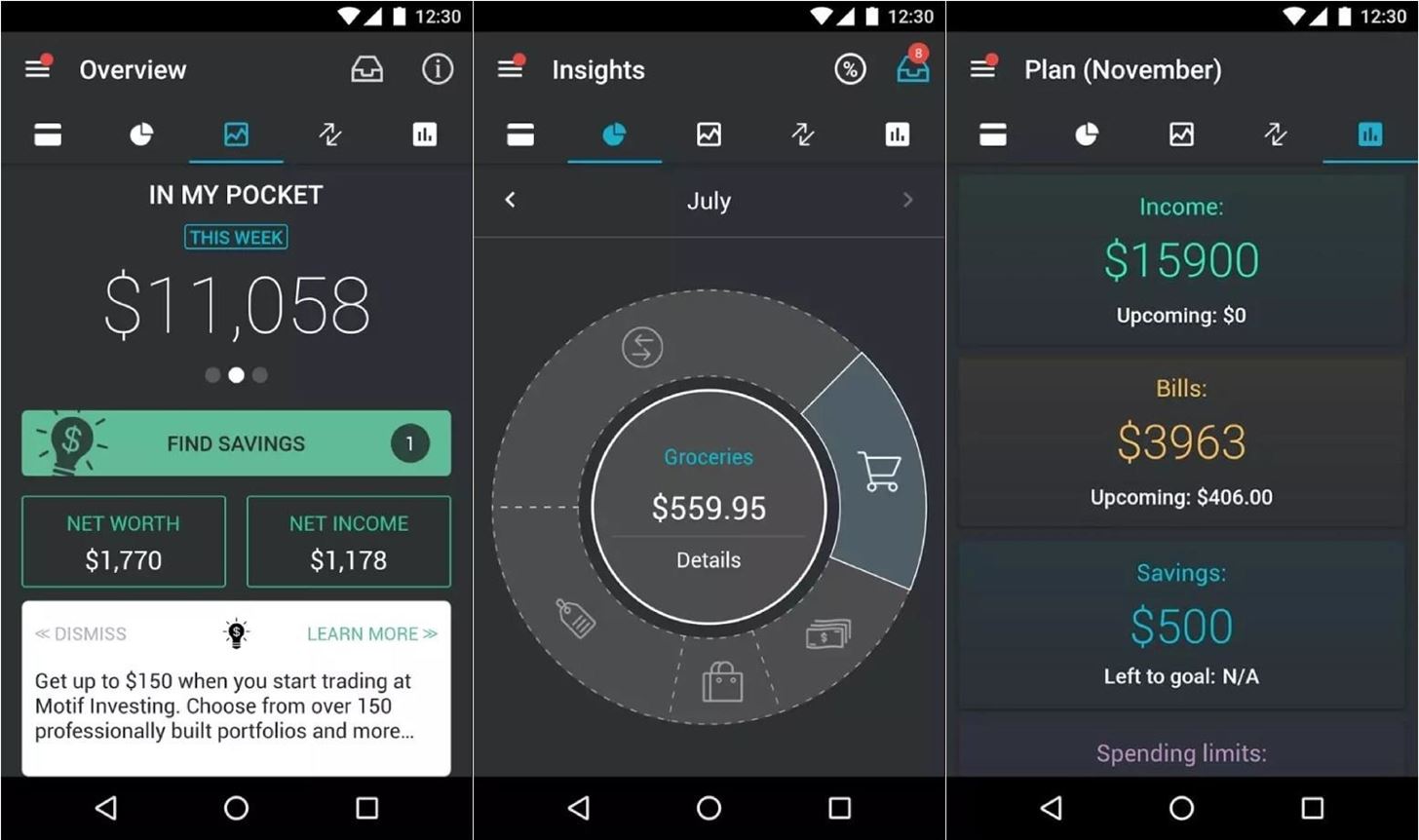

3. PocketGuard

PocketGuard is another great budgeting app that connects directly to your bank accounts, giving you constant access to your balance and transactions. PocketGuard has an incredibly simple interface that basically bottom lines your budget for you.

The app shows you how much money is in your pocket, displays your income and how much you have spent, and does it with a no-frills flair. PocketGuard analyzes your spending to identify recurring payments that you need to plan ahead for, and presents your total income to give you a precise picture of your cash flow.

Simple charts outline where your money goes, and tapping on them will show you what areas are consuming the most cash. PocketGuard charts are an awesome tool in zeroing into specific categories to cut back on spending and get the most out of your hard-earned cash.

- Install PocketGuard for free from the iOS App Store

- Install PocketGuard for free from the Google Play Store

Make It Good

Use these apps to keep track of your budget and remind you of your promises of a better, stronger version of yourself. We need every little bit of help and all tools at our disposal when it comes to keeping our resolutions, and while receiving support from seemingly insignificant apps doesn't amount to much on the surface, it'll certainly go a long way in helping you achieve your goals. A hundred tiny good habits amounts to a ton of success in self-improvement.

Just updated your iPhone? You'll find new emoji, enhanced security, podcast transcripts, Apple Cash virtual numbers, and other useful features. There are even new additions hidden within Safari. Find out what's new and changed on your iPhone with the iOS 17.4 update.

Be the First to Comment

Share Your Thoughts